The 2019 Texas Legislature had many ambitious projects for the session, ranging from school finance reform to school safety to disaster response post-Hurricane Harvey. However, the legislature managed to tackle all these by the end of the legislative session in late May. By June 16, Abbott signed bills from the session, many of which are products of years of back-and-forth discussions. Here are some of the notable newly-signed laws that will take effect Sept. 1.

First, let’s tackle the big-ticket bills from the session: Property tax reform and school finance reform.

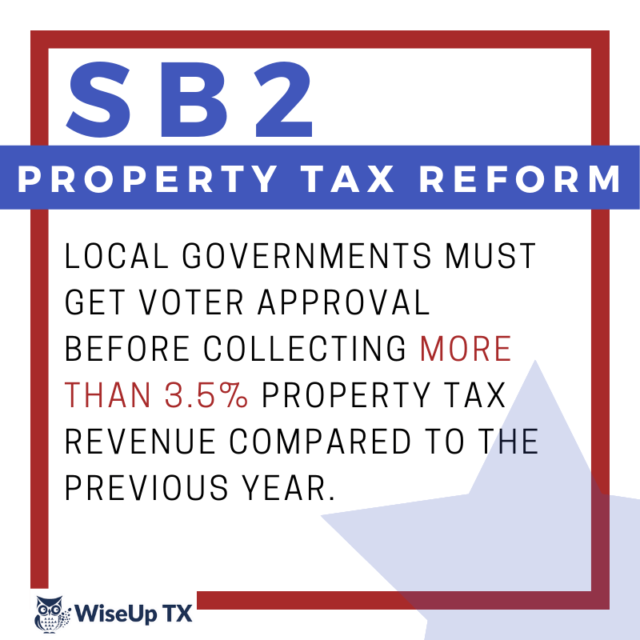

Property taxes was a point of contention in the state. Many people wanted to see lower tax rates, however, many local services, including public schools, rely on property tax revenue to function. The main aspect of this bill was to lower property tax revenue and to demystify the process to taxpayers. Local governments now must go to voters if it would like to increase its property tax revenue over by more than 3.5%. The bill also includes a provision that would create an online database for property owners to show the impact of potential rate changes, with the idea of streamlining the voter approval process.

Though property tax revenue is largely associated with school districts and colleges, the decrease in revenue has the potential to impact other city services.1

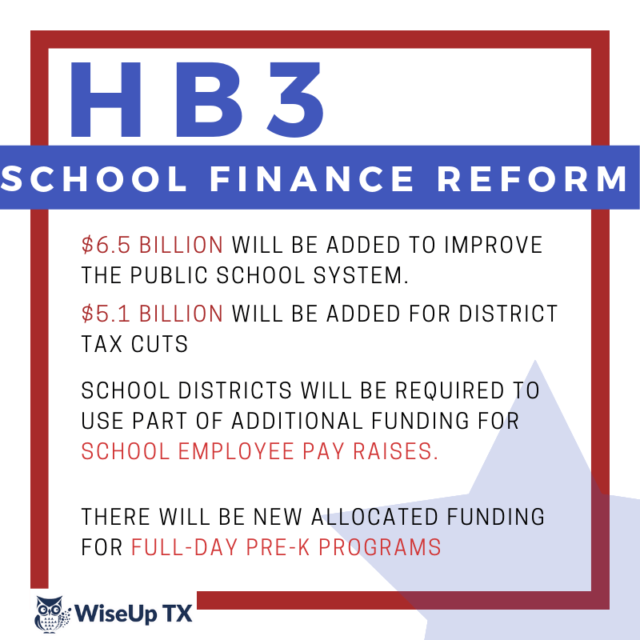

HB3 is the school finance reform the legislature has been putting off for years.2 In a vague summary, the public school finance system up until now was a constant fight between state government funding and local property taxes. As the years went on, the Texas government was funding less and less, thus public schools had to resort to their area’s local property tax revenue to fund their own individual districts. Thus, areas with higher property taxes would inevitably have higher property tax revenue and likely well-funded public schools. The state’s solution was the “Robinhood Recapture” process, where TEXT IS MISSING HERE 3

In 1973, Texas’ way of financing was challenged in a Supreme Court case, San Antonio ISD v. Rodriguez. The case examined whether or not Texas’ public school finance system was fundamentally based on wealth-based discrimination and if that consequently went against the fourteenth amendment. Though the court ruled in the ISD’s favor, the case brought up a question that would not be fully addressed in the Legislature until 2019: Is the Texas public school finance system ethical and sustainable?

The 2019 Texas Legislature looked to reform the system with House Bill 3. In short, the bill includes $6.5 billion to improve the public school system and a separate $ 5.1 billion for school district tax cuts. The school districts are required to use part of the increase to be spent on school employees’ raises, however, the exact amount allocated is unclear. There is allocated money for districts who wish to pursue merit-pay programs for high-level teachers and there is funding for full-day-pre-K for eligible children.4

The money allocated for tax cuts is part of a larger ambition to lower tax rates in the future. Lowering the rates would reduce revenue and thus, the state would be required to reimburse districts for the money lost.

There is no clear answer as to where the money is coming from. Previously, Abbott and lawmakers relied on a 1% increased sales tax bill, however, the bill has failed. The cost of this reform is expected to increase by about $2 billion in 2022 and 2023.

Budget Bill

Of course, these measures also involve the biennial budget the Legislature approves every session. Here’s an overview on the upcoming budget.

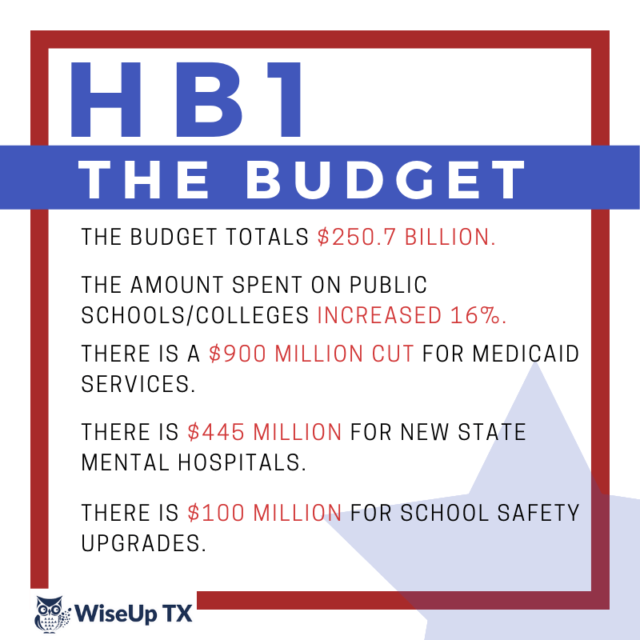

HB1 is the $250.7 billion two-year budget, which is a 16% spending increase from the 2017 legislative session. The budget includes $94.5 billion for public schools and universities, a 16% in spending from the previous budget. There is $84billion for health and human services programs.

There is an approximately $900 million cut to Medicaid, however the Texas Health and Human Services Commission will decide which specific services may be cut.

The state has an “Economic Stabilization Fund” aka the “rainy day” fund as a state savings account. Lawmakers have authorized a $6.1 billion withdrawal to cover unpaid bills from prior years and to use for Hurricane Harvey recovery and infrastructure projects. The other projects include, but are not limited to: $445 million to build new state mental hospitals, $100million for school districts to install safety upgrades, and $11 million for Santa Fe ISD.

Controversial Issues

From religious freedom to school safety, the legislature passed many bills on controversial issues, inciting discussion on the role of government in social issues. Some of these bills further reinforced Texas’ socially conservative stances on issues such as abortion.

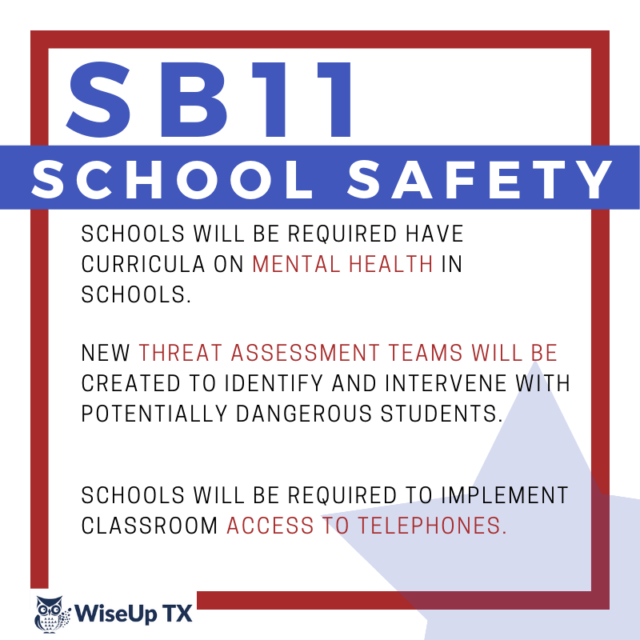

This is the first legislative session following the shooting at Santa Fe High School in 2018, thus the Legislature was under pressure to make effective school safety measures to ensure such an incident does not occur again. Lawmakers decided to increase mental health initiatives in schools by requiring curricula on mental health. The bill also will train school district employees to respond to emergency situations by implementing classroom access to electronic communication. It establishes a “threat assessment teams,” designed to identify potentially dangerous students and determine a way of intervention. The teams are not allowed to provide mental health treatment to students under 18 without parental consent.5

SB22 would ban state and local governments from partnering with companies that perform abortions, even if the task is not related to it. It bans any transfer of money, goods, or services, from abortion providers. In short, it does not allow governments to use of taxpayer dollars in any way with these providers.6

After Chick-fil-A was barred from opening in San Antonio International Airport for being openly anti-LGBTQ, Texas lawmakers passed SB1978 to ensure local governments could not take “adverse action” on businesses based on their religious values. The biTll was a point of contention among lawmakers, as it had been killed in the House before making a resurrection in the Senate.7

The legislature opted to repeal the Driver Responsibility Program, which would add an annual yearly fee on top of the price of a traffic violation. If the fines weren’t paid within 105 days, the drivers would have their licenses suspended. Critics would point out that this program unfairly hurt lower-income households. If a person were unable to pay the bill, they would have their license suspended. The very license that would help them get to their job.8

The issue was that the fines from the program funded about half of emergency trauma care centers, which put this infamous program on the back burner for years. Now, the legislature found other ways to compensate for the lost revenue, thus they were able to finally repeal the program.9

Infrastructure and Every Day Life

Last, but certainly not least, there were bills that revolved around infrastructure and dealt with the everyday life of citizens.

For day-to-day citizens, the bill will increase the smoking age from 18 to 21, making Texas the 14th state to do so. The restriction applies to all tobacco products, including e-cigarette products.10

Texas intersections of red-light cameras are no more in an effort to preserve the right of due process guaranteed in the Texas Constitution. However, many local governments as the cameras reduce accidents. Additionally, fines from red-light camera violations fund trauma care centers. It’s estimated that the ban will cut trauma care center funding by $28 million in the next two years.

As briefly mentioned in the part about HB1, this bill uses $1.7 billion from the “rainy day fund” to fund flood repairs and programs. There are two funds the legislation includes: the Flood Infrastructure Fund and the Texas Infrastructure Resiliency Fund. The first would provide financial assistance to repairs and flood control projects, however voters will vote on it in November. The second would assist local governments in projects that are eligible for partial federal funding.11

In Conclusion

Again, it’s important to note that these are a little over half of the laws that Abbott signed. Nonetheless, the changes made this session will have a profound impact on the everyday life of many Texas citizens. Many laws will have a “snowball” effect and sometimes, the unintended consequences are the largest ones. Keep an eye out on how these few bills affect your community’s life so you can be prepared for the next round of elections.

References

- https://www.texastribune.org/2019/05/25/texas-house-approves-property-tax-reform-package-sending-it-senate/

- https://www.texastribune.org/2019/05/24/texas-school-finance-bill-here-are-details/

- https://www.texastribune.org/2019/05/23/texas-school-finance-reform-property-tax-deals-finalized-legislature/

- https://www.texastribune.org/2019/05/25/Texas-teacher-pay-raise-school-finance-HB3-passes/

- https://www.texastribune.org/2019/05/21/texas-school-safety-measures-expanded-house-changes-senate-bill-11/

- https://www.texastribune.org/2019/05/24/texas-abortion-bill-called-biggest-threat-planned-parenthood-passes

- https://www.nbcnews.com/feature/nbc-out/save-chick-fil-bill-advances-texas-legislature-n1008231

- https://www.texastribune.org/2019/05/01/texas-house-passes-bill-kill-driver-responsibility-program/

- https://www.txsurchargeonline.com

- https://www.texastribune.org/2019/05/14/texas-legal-age-tobacco-21-senate-bill-21/

- https://www.texastribune.org/2019/05/26/lawmakers-approve-bill-to-help-fund-floor-control-projects-in-texas/